Apprenticeships

An Apprenticeship is where an individual is employed in a real job by a company, while studying for a formal qualification at college. They will have a contract of employment, get paid a salary and be entitled to all the statutory benefits such as holiday and sick pay. Anyone living in England over the age of 16 and not in full-time education can apply.

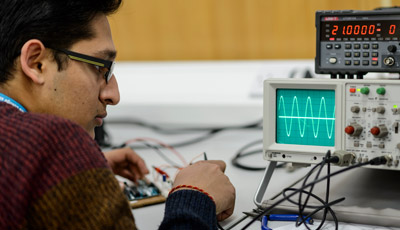

Apprenticeships are available in a wide range of industries. Some of our most popular Apprenticeships include business & administration, engineering, construction and plumbing and electrical. Over the years we have worked with large and well known employers such as British Airways, L’Oreal and South West Trains. We are proud to have some of the highest apprenticeship success rates of any College Group around.

For more information, please email us on This email address is being protected from spambots. You need JavaScript enabled to view it.

Apprenticeship Courses at South Thames Colleges Group

- Accounting and Finance 1 course

Explore Accounting and Finance at

- Computing and IT 2 courses

Explore Computing and IT at

- Customer Service 2 courses

Explore Customer Service at

- Hospitality and Catering 2 courses

Explore Hospitality and Catering at

- Motor Vehicle/Electric Vehicle 1 course

Explore Motor Vehicle/Electric Vehicle at

- Professional and Personal Skills 4 courses

Explore Professional and Personal Skills at

- Teaching and Training 1 course

Explore Teaching and Training at

- Business 7 courses

Explore Business at

South Thames college kingston college

- Accounts or Finance Assistant Apprenticeship - Level 2

- Business and Administration Apprenticeship - Level 3

- Chartered Manager Degree Apprenticeship - Level 6

- Customer Service Practitioner Apprenticeship - Level 2

- HR Support Apprenticeship - Level 3

- Information Communications Technician Apprenticeship - Level 3

- People Professional Apprenticeship - Level 5

- Accounts or Finance Assistant Apprenticeship - Level 2

- Construction 5 courses

Explore Construction at

- Health and Social Care 1 course

Explore Health and Social Care at

- Plumbing 1 course

Explore Plumbing at